Choppy chop - Week in review (May 27 - May 31)

Very choppy week.

Looked like market was going to finish with a big loss, but then it had a huge rally in literally the last 20 minutes of the day to finish the week just slightly down.

Lucky for me, because it looked like I was going to eat some major losses otherwise.

Opened a bunch of new positions; I think I'm getting a bit restless:

Opened #

| Ticker | Action | Type | Date | Expiry | Sell Strike | Buy Strike | Premium | Qty | Fee | Net |

|---|---|---|---|---|---|---|---|---|---|---|

| CSCO | open | Covered Call | 2024-05-28 | 2024-06-07 | 47.5 | - | 0.33 | 1 | 1.05 | 31.95 |

| AMZN | open | BPS | 2024-05-28 | 2024-07-19 | 170 | 165 | 0.9 | 2 | 2.82 | 177.18 |

| MSFT | open | BPS | 2024-05-28 | 2024-09-20 | 380 | 370 | 1.16 | 1 | 1.41 | 114.59 |

| SPY | open | BPS | 2024-05-28 | 2024-06-07 | 520 | 509 | 0.66 | 3 | 4.2 | 193.8 |

| BITO | open | Short Put | 2024-05-28 | 2024-06-21 | 22 | - | 0.22 | 1 | 0.8 | 21.2 |

| V | open | BPS | 2024-05-29 | 2024-07-19 | 260 | 255 | 0.89 | 2 | 1.4 | 176.6 |

Weekly SPY and MSFT trades.

New covered call on CSCO as I'm trying to get rid of 100 shares that I was assigned last week. Unfortunately, it dropped some more, and is in a short downtrend right now.

Naked put on BITO, which is a bitcoin ETF. No fundamentals to really consider, but I am bullish on bitcoin long term. Very speculative position, but it's low priced, so just sort of messing around.

Closed / Expired: #

| Ticker | Action | Type | Date | Expiry | Sell Strike | Buy Strike | Premium | Qty | Fee | Net | Profit/Loss |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SPY | open | BPS | 2024-05-21 | 2024-05-31 | 521 | 513 | 0.61 | 3 | 6.42 | 176.58 | $176.58 |

| SPY | expired | BPS | 2024-05-31 | 2024-05-31 | 513 | 521 | 0 | 3 | 0 | 0 |

- Closed Net Profits/Loss: $176.58

Just the weekly SPY position closed/expired. Looked like it was going to close for a loss, but got lucky in the end.

Notes and Lessons #

Ended the month on a positive note.

Have a couple positions that I may need to take a loss on soon though, so next month may start in the negative.

Scaling up #

I started scaling up my weekly SPY positions. I went from a quantity of 2 to 3. It also bit me in the ass right away as the market started to drop, but I got fortunate in the end.

Unbalanced portfolio #

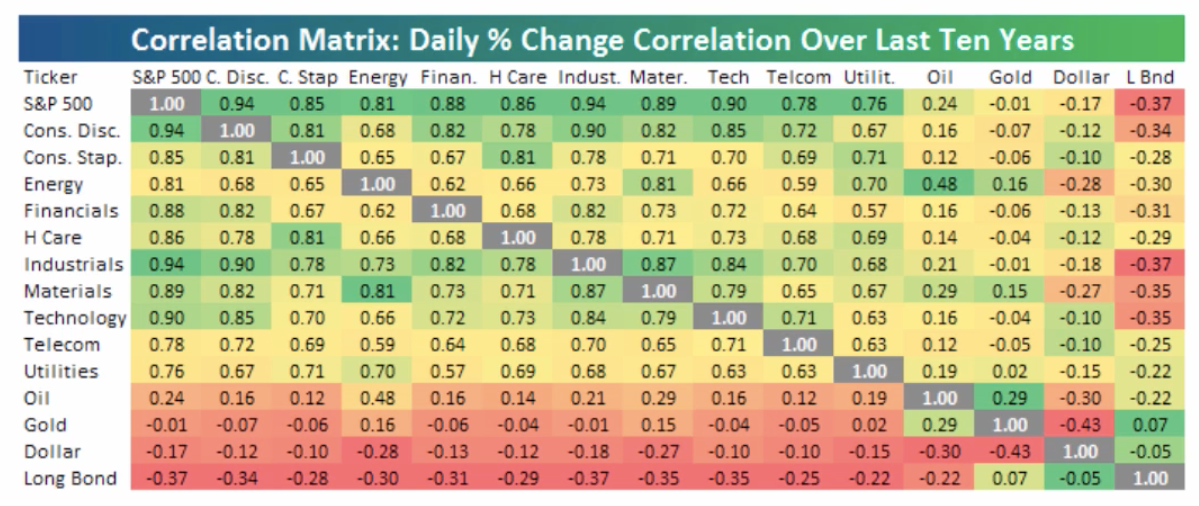

I have way too many bullish positions right now. Also, all my strategies are basically bullish (or neutral). Whenever the market has a downturn, I typically end up with losses.

I need to find a way to better diversify my holdings or take more bearish positions somehow.

Most of the positions I have are in either tech or consumer based industries. So, perhaps need to trade more in like oil or gold? Below is a correlation matrix from Option Alpha:

Need to research some bearish strategies that I can look at consistently.