Week in review (May 22 - 26) - Giant losses, iron condoring

Things got a bit out of control this week.

I was trading everything and anything.

Resulted in a big loss, and more big losses to potentially come soon.

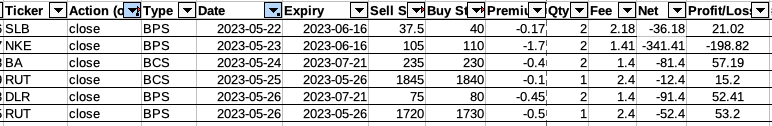

Too many trades to go through individually, but here's a screenshot of the trades I opened and closed.

Opened:

- BA, RUT (x2), IBM, TGT (x2), MU (x2), DLR, GIS, WFC, ADBE (x2), SYF

Closed:

- SLB, NKE, BA, RUT (x2), DLR

- Closed Net Profits: $0.2 😂

Notes and Lessons #

Through my reckless trading this week, I learned a few things:

- Announcements of related companies have a big effect

- Don't be overexposed to one industry

- Iron Condors to reduce losses

NKE, MU and effects of related company news #

My NKE position was initially doing well. I entered at the 😀, and it bounced off support just like I had hoped. I could've taken profits right there, but it looked like it would keep going up a bit more.

Then, Foot Locker released some terrible ass earnings and took a nose dive. This caused NKE to also plummet, as they sell their shoes at Foot Locker?

I decided to cut my losses at the 😩. Biggest loss to date of about $190.

So, the lesson here is maybe I need to also be aware of earnings of tightly related companies.

This trade got me annoyed, so I started just trading everything I could to make back my loss.

Then, the exact same thing happened, but in the opposite direction, with MU.

I was bearish on MU, as it had spiked up, but had bad earnings a month ago, and some recent bad news out of China. So, I thought it was due to drop a bit.

But, then NVDA released amazing earnings, so all the microchip and tech companies boomed up with it. This brings me to the next point:

Overexposure to one industry #

In my recklessness earlier in the week, I entered too many similar positions in the same industry. I was already in a bearish trade in MU, but then also entered a bearish trade in ADBE. Adobe is not a chip company, but they're all big tech industry, so they still move together on major news.

So, now I'm stuck in two of the same positions sitting at big losses.

Iron Condor to reduce Credit Spread Loss #

Instead of taking my losses right now, I have decided to try an 'Iron Condor' adjustment strategy to reduce/limit my loss.

How it works:

Initially on ADBE, I sold a Bear Call Credit Spread (420/425 strikes) for $78. So, my max risk is $422 (per position).

The price then moved up against my position. I could've taken my loss, but instead I sold a Bull Put Spread (340/335 strike) for $70. I don't take on anymore risk, as it is the same width in strike prices ($5). Now, my max risk per is just $352 ($422- $70).

If the stock price keeps moving up, I can roll the Put Spread up to reduce my total risk further.

I'm thinking I will still end up taking a loss, but hopefully I can reduce it to something more manageable.

We'll see how this all works out next week!