Option Alpha Trade Ideas Strategy

Option Alpha is a great resource for learning about trading options. They also have their own app/platform that lets you auto-trade strategies. Their platform doesn't work with my broker yet (IBKR), otherwise I would probably be using it.

The platform also has "trade ideas" screener which gives you high probability / expected value trades.

Overview #

The main idea touted by Option Alpha is to use a very mathematical approach, and the "law of large numbers".

Basically, make a lot trades that have good probability/return on risk/expected value.

As long as you control your risk (i.e position size), you will eventually come out on top.

Sounds quite simple doesn't it.

Entry rules #

I will look to make 3-5 trades per week based on "trade ideas" found on the Option Alpha platform.

Will also be using it to hedge, or diversify my other positions.

If I have too many bullish positions, I will look for some bearish trades to make. Or, if I have too many trades on tech companies, will look for other industry to trade.

Other entry rules:

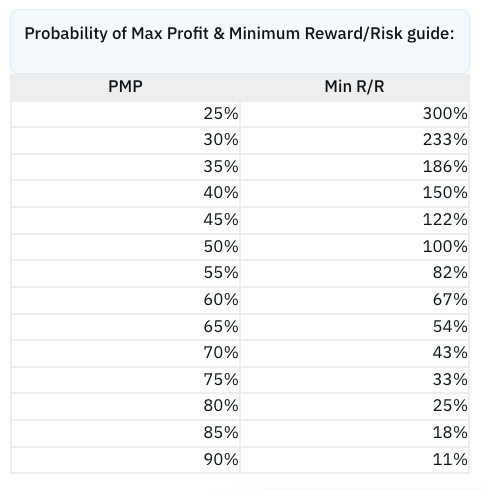

- Reward/Risk must be greater than the percent on this chart depending on dislayed probability of max profit:

- mainly be targetting trades in the 50-65% probability range

- avoid trades where earnings are within 2 weeks (less accurate probabilities)

- prefer trades with high implied volatility rank or IV percentile

- trade symbols that have high volume / open interest (at least 300 each leg)

- only defined risk trades (i.e. credit spreads, iron condors, etc.)

-

20 DTE (reason)

- prefer ETFS over stocks (reason)

- Distribute trades across different expiry dates, so that not everything expires on the same week. Maybe 2-3 positions per expiry date

Exit rules #

- Take profit at 50-75% of initial collected premium

- No stop loss. Loss is limited to position size / risk level

Risk level / Position size #

Each trade, I want to risk less than $100. This is about 0.3% of my portfolio size. Since I will be making many trades per week, I think it is smarter to have lower risk than 1% of portfolio.

I will first be only targetting $1 - $2 wide spreads. That will mean my max loss for each position will typically be around $50-$100 (based on 50% probability of max profit).

Summary / Pros / Cons #

Interested to see how this almost purely mathematical approach works. No need to look at technical indicators or anything.

The good thing is that there is literally always a trade to make if I want to.

The bad thing is that there is too many ideas to trade, and is probably easy to overtrade.

I noticed the platform still lists trades where the spreads are super wide. So, I will need to be careful when placing my orders.